… Let me tell you how it will be

There’s one for you, nineteen for me

‘Cause I’m the taxman

Yeah, I’m the taxman

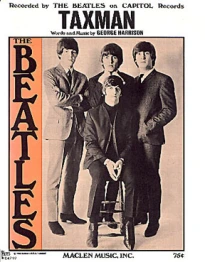

The Beatles song composed by George Harrison captured a common sentiment, but with proper planning taxes can be kept to a minimum and the tax attorneys at Pierro, Connor & Strauss, LLC are ready to assist. Our team works to develop a plan to minimize taxes during and after a client’s lifetime, utilizing a variety of techniques designed to maximize income and build wealth for our clients and transfer it efficiently to their children or other designated beneficiaries.

The tax planning department will guide clients on business and personal tax planning and will prepare estate and gift tax returns including assistance in resolving audits of estate and gift tax returns. In addition, we will consult with our clients to help them fully understand their retirement benefits and advise and develop strategies to maximize the benefits our clients and their heirs receive from their retirement plans. Key services in Tax Planning include:

Developing an Estate Plan to Maximize the use of the Estate Tax Exemption:

Does your existing estate plan provide for the maximum use of your estate tax exemption in order to maximize the wealth you transfer to the next generation? In 2025, the ability to gift money without filing a gift tax return rose to $19,000 per individual/year. The federal gift and estate tax exclusion rose to $13,990,000 per person up from $13,610,000 in 2024. In New York State, the estate tax exemption rose to $7,160,000 in 2025 up from $6,940,000 in 2024, and yet it’s important to know that if you pass away within three years – gifted assets are taxable in your estate. A step-up in basis is still available upon death which is an advantage to your beneficiaries, if planning is done precisely. Portability of exemptions between spouses for federal and estate tax purposes is also important to understand. We will review an existing plan and consult with you to develop strategies to maximize the use of your estate tax exemption.