ESTATE PLANNING FOR ART, COLLECTIBLES, AND NFTS

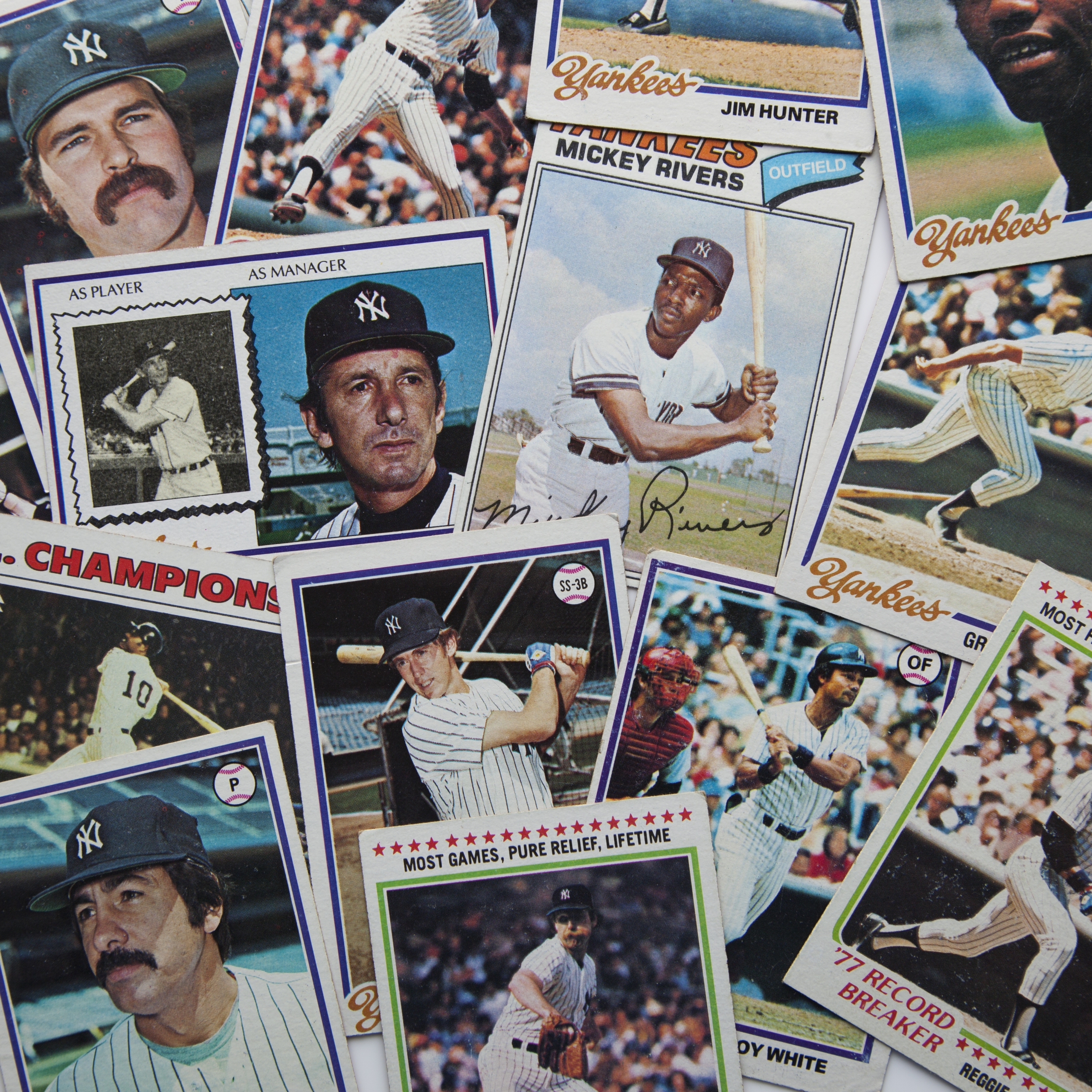

Collectibles such as art, non-fungible tokens (NFTs), jewelry, antiques, sports memorabilia, wine and coins, present unique issues in the estate planning process. There are many options to meet your wishes and needs when it comes to the future of your art and other collectibles, but pre-planning is essential. Speaking with an experienced estate and trust planning lawyer who understands the nuances of planning for these assets is an important first step.

The team at Pierro, Connor & Strauss has extensive experience in estate planning for art and collectibles, and how they can be incorporated into your estate plan. Call to schedule a free consultation with one of our art estate planning lawyers.